Posted on 13, January 2014

in Category bsg insight

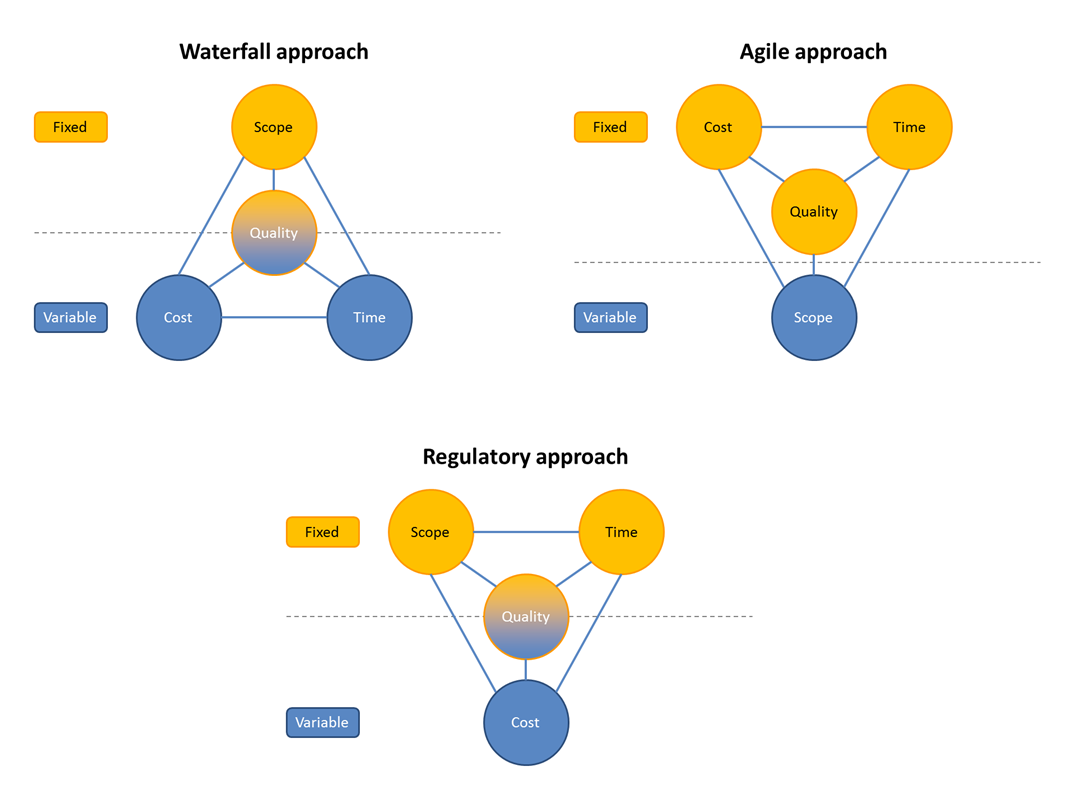

Do you remember the story of Eva and Tim? Refresh your memory here. While there is no one-size-fits-all answer to Eva’s predicament, there are a series of dimensions which she can consider to help shape how she chooses to respond. In this post, we explore those dimensions. In our experience helping clients with compliance projects, we’ve noticed some fundamental aspects in which these regulatory change initiatives are different from other business-driven change initiatives. We thought we’d share 5 of the most distinctive differences, which you might have already considered in Eva’s struggle. Drop dead dates Deadlines are fixed and set externally. [&hellip

Read More

Posted on 7, January 2014

in Category bsg insight

Have you ever experienced a project delivering regulatory change? Did you notice any differences compared to other projects? Here’s a little story inspired by our experiences. Any connections with real life characters are unlikely and even if you are new to regulatory work, don’t stop here; you will still enjoy it. 21st century London. Seagulls fly around the Shard, light drizzle dampens the pavement and the Waterloo and City line still resembles a tin of sardines more than a tube. Eva, is a business unit leader at the retail arm of First Compliant Bank (FCB). Her team uses an internal system [&hellip

Read More

Posted on 27, June 2013

in Category bsg insight

Why is this important? Why is it happening? The retail investment market has been a lucrative space for many years, however over the last decade it has had its fair share of scandals. The key area of concern currently under scrutiny is the delivery of financial advice and the subsequent sale of financial products. With the current approach, financial advisers receive commissions on products provided to clients – a framework that can introduce a bias to the financial advice which is given. Product providers that offer advisors attractive commissions get favoured, very often steering advisors away from keeping clients’ interests [&hellip

Read More

Posted on 7, June 2013

in Category bsg insight

by Jacqui Newling, owner of our regulatory compliance service We’re helping many of our banking clients to effect the implementation of regulatory change. These programmes are extensive and complex. In order to help get our head around this, we took some time to reflect and identify key themes in these programmes. Taking a macro view allows us to consider how to implement these changes in a flexible and scalable manner. Our belief is that institutions that are setup to roll out compliance change effectively and quickly will be in a better position to focus on the business rather than the [&hellip

Read More

Posted on 22, April 2013

in Category bsg insight

There’s been a lot of banter recently about ‘banking culture’, how it’s all wrong and it’s at the heart of many of the bank’s problems – particularly that of investment banks. The industry has become synonymous with society’s ills – greed, immorality, recklessness – and bankers are emblazoned in scandal. They’re responsible for everything from miss-selling insurance products to being conduits for money laundering and rigging Libor (or, if you like, Lie-bor). All of this comes in the wake of a financial meltdown. Caused by bankers. Saved by the taxpayer

Read More

Posted on 1, February 2013

in Category bsg insight

Compliance related fines totalled more than $3.5bn in 2012. Financial sector compliance has moved from the business pages to the front page. LIBOR, regulations, capital adequacy, anti- money laundering and other industry terms are becoming discussed as regularly as last week’s football results. We’ve observed in many clients that when people speak about compliance it tends to be reactive – a problem has been identified and it needs to be fixed. Businesses tend not to see compliance in a strategic fashion as it has traditionally been a cost centre that has not contributed to the bottom line. A seismic perception [&hellip

Read More

Posted on 15, January 2013

in Category bsg insight

Compliance is just a business case for another form of business change. In a recent assignment to assess FATCA readiness at a banking client, we discovered that the three different banking products each had a different front-office origination process. In the wake of this discovery, part of our recommendation set was, unsurprisingly, to consolidate processes and reap the various benefits that accrue from this. It all seems so obvious – but is it really? All too often All too often compliance projects start with a specific endpoint – ensure that we get the compliance projects relevant tick in the relevant [&hellip

Read More

Posted on 18, October 2012

in Category bsg insight

Compliance. Why is it important? Supporting notes can be found here (Slideshare)

Read More

Posted on 16, October 2012

in Category knowledge

Converting criminal income into assets that makes it difficult to trace the underlying crime is easier if we all turn a blind eye to it. The methods are always changing but so should the remedial tactics to deal with it. 2012 10 bsg uk aml kyc briefing version 1 from BSG (UK)

Read More